Direct VS Indirect Taxes

Tax Types in India

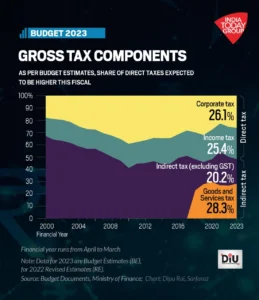

Evolving tax structure

DIRECT VS INDIRECT TAX - changing share in overall collection - good or bad

In financial year 2022-23, India's direct tax collection is expected to be marginally more than indirect taxes, thereby reversing streak that started in pandemic period.

- In 1991, india had a 2% of GDP collection from direct taxes & 8% from indirect taxes.

- In FY22, the share of direct tax is 5.42% & indirect tax in India’s gross domestic product (GDP) is 5.38%.

Direct taxes include income tax ( Tax on incomes of individuals) & corporation tax ( Tax on incomes of businesses of companies. Direct tax includes inheritance tax and wealth tax, later abolished in 1985 and 2015 respectively. Direct taxes are considered more equitable & a measure of compliance levels & development. In most developed countries, the share of direct taxes in the total taxes collection is far more than the indirect taxes.

Indirect taxes are levied on goods & services and not on income, profit or revenue of individuals buying or consuming. They are paid indirectly, i.e. though paid from pockets of consumers but deposited with the government by someone else, which could be a manufacturer, trader or a service provider.

Taxes under this head are GST, central excise duty( taxes on domestic production at factory level), & customs(import or export duty).

Indirect taxes are considered unequal & regressive in so far as their impact is concerned. Poor pay them at a similar rate as a rich individual, thereby putting a proportionately bigger burden on them.

Where Taxes come From

DIRECT VS INDIRECT TAX - As you can see from above figure - that direct tax that includes income tax and corporate tax is almost more than 51%

- Corporate tax has a highest share in total revenue collection.

- Only 2.24 crore indians pay income tax out of a total population of 144 crores & total 7.40 crore people who file returns. Those filing returns eventually turn into a zero tax incidence category. Incidence means that the Tax liability is zero.