INDIA's CRITICAL MINERAL QUEST

India’s critical mineral trade is up 10 times in ten years

- India’s critical mineral imports have increased over tenfold in ten years from $475 million in FY15 to $4.93 billion in FY24, according to an analysis of commerce ministry data.

- This increase in trade has come with an increased reliance on finished products and China.

- It is not surprising that India is signing critical mineral agreements and securing supply chains to deleverage its dependence on Chinese imports.

- Battery packs, including lithium-ion batteries, accounted for 68 percent of the country’s total critical mineral imports in FY24, up from 44.5 percent in FY15.

INDIA CRITICAL MINERALS IMPORT DEMAND SCENARIO - How India is trying to ensure its critical mineral requirement

India join's Minerals Security Partnership to reduce dependence on china

In 2023, India joined the Minerals Security Partnership, a US-led partnership to create critical energy minerals supply chains. The country reportedly is actively pursuing strategic partnerships in Africa and Latin America to secure critical minerals.

India's Minister of Commerce and Industry Piyush Goyal, and US Secretary of Commerce Gina Raimondo signed a new MOU to expand and diversify critical mineral supply chains, according to a report by the Indian Express.

India looking to partner USA for Critical Minerals supply

INDIA CRITICAL MINERALS IMPORT DEMAND SCENARIO

India has proposed a partnership agreement on critical minerals to the US, hoping it could lead to a broader free trade agreement that would help local electric vehicle (EV) makers benefit in the US market.

Observers said that the proposal is purely driven by geopolitical motives rather than commercial interests. As India's key mineral resources are heavily dependent on Chinese imports, analysts remain skeptical on whether India's recent moves on mineral fields could achieve the desired results, or just make it a pawn of the US Indo-Pacific strategy that aims at countering China.

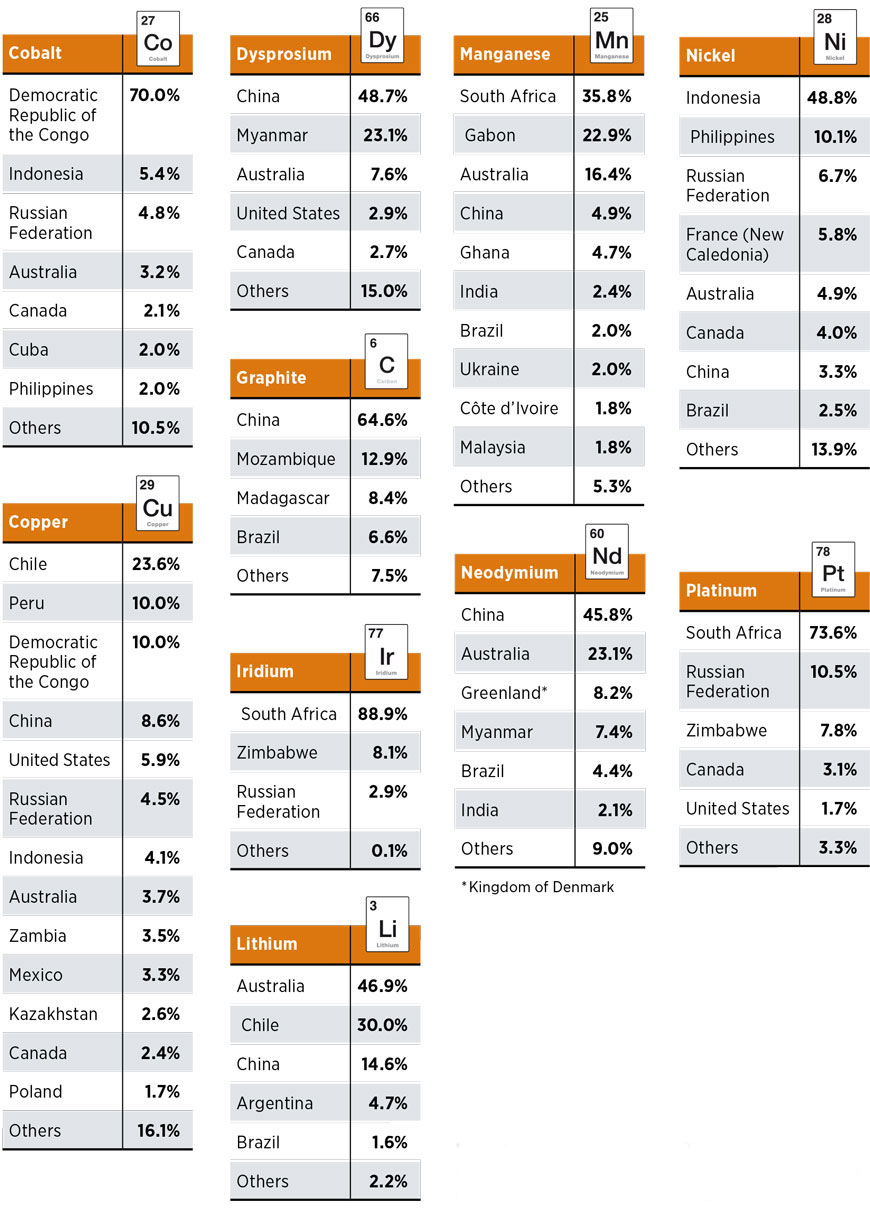

The mining and processing landscape of critical materials is geographically concentrated, with a select group of countries playing a dominant role. In the mining of critical materials, dominant positions are held by Australia (lithium), Chile (copper and lithium), China (graphite, rare earths), the Democratic Republic of Congo (cobalt), Indonesia (nickel) and South Africa (platinum, iridium). This concentration becomes even more pronounced in the processing stage, with China currently accounting for 100% of the refined supply of natural graphite and dysprosium (a rare earth element), 70% of cobalt, and almost 60% of lithium and manganese (Figure S2).

FIGURE S2 Key mining countries for select minerals